Owing CRA big money at tax time feels like a train plows into you.

“I felt like someone punched me and took my breath away.

How could I owe that much tax?”

…….Reg. L, Customer

You don’t have to be caught unaware!

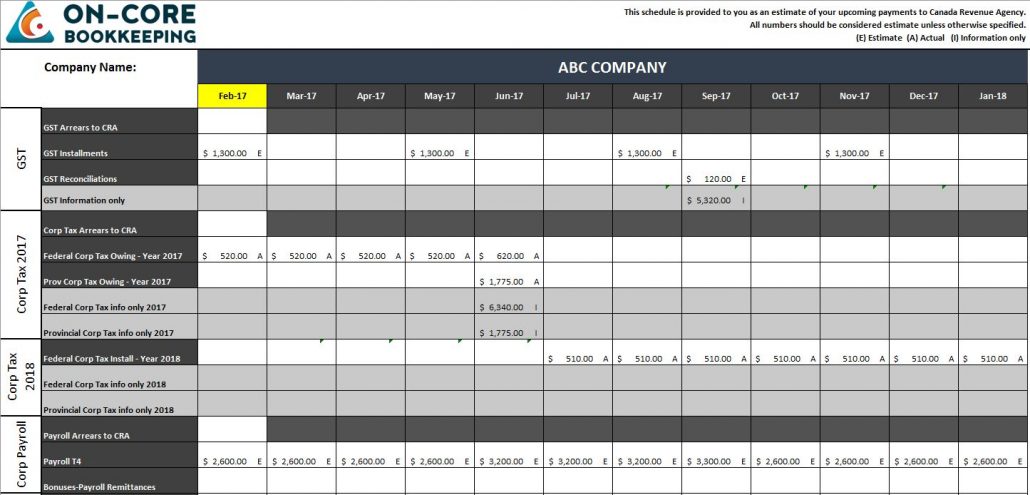

On-Core can help you forecast what you will owe CRA for the next 12 months!

No more surprises! No more interest and penalties!

Why get a 12 month forecast?

Having an incorporated company can make it confusing about what tax is owed, and why you owe it. The CRA expects business owners take the time to understand what you will owe, and if you don’t make your payments on time, then you will pay penalties and/or interest.

Here are the 5 top reasons you may want to get this done…

- Most corporations have a monthly payment obligation for corporate taxes, but most business owners are not aware of this

- If you “just take money” out of your company without declaring it to CRA, you may end up paying penalties on this money

- You are required to prepay GST and corporate taxes

- Your tax payments are due BEFORE your tax return is done (yes…indeed…that is true)

- You can anticipate your tax bills for the future to avoid getting interest on unpaid amounts

The CRA forecast can be done at any time, and it is built for those individuals that just hate those big CRA bills!