Another report that a bookkeeper will send is a Profit & Loss, it may also be called an income statement. This is an important report for a business owner to understand, as it shows if the company is making money in the year. Not only can it give an indication on the health of the company, because it will show if the expenses are more than the revenue; It will also help an owner to understand taxes owing. If the company has a large profit halfway through the year, the owner should be expecting a significant tax bill come their year end.

Something that must be noted about the Profit & Loss statement, is that it does not show all the money spent by the company. For example, if the company has purchased a $3,000 computer, this will show up on the Balance Sheet as an asset, and not on the Profit & Loss. This statement will also not show any money paid to government bodies for taxes and liabilities, or the payment of loans. Therefore, you can not rely on the Profit & Loss for the cash flow of the company.

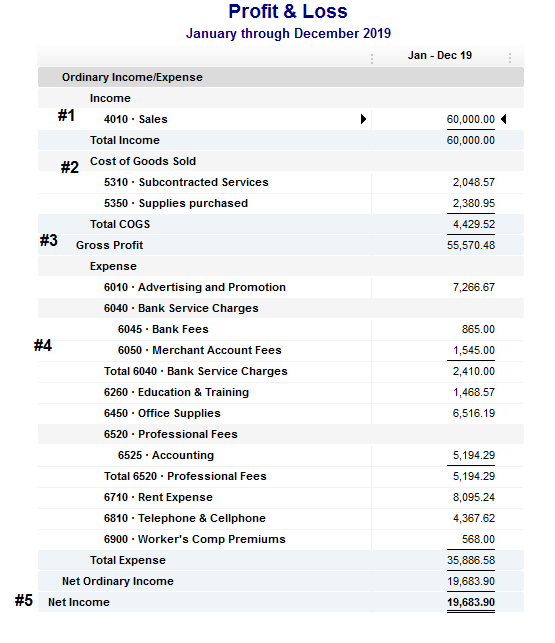

Below is an example of a Profit & Loss, and a brief explanation of what each section is.

#1. Income

The first section on the Profit & Loss shows the sales of the company. This number does not include GST. This number will come from either invoices or sales receipts, depending on the business.

#2. Cost of Goods Sold (COGS)

The COGS section represents items that contribute directly to the product or service provided by the company. Some examples of this would be:

- Retail – the cost of the items that you resell would be included in this section

- Manufacturing – the cost of all the parts that go into the item produced would be COGS

Not every company will have this on their Profit & Loss.

#3. Gross Margin

Gross Margin is simply the Income – COGS. This total shows you how much is left over to pay for the general expenses of the company.

#4. Expenses

The expenses in this section relate to the general operations of the company. This can include purchases for office supplies, postage, rent, advertising, and memberships. They are all expenses that a company must incur, but they are not directly related to the product/services sold.

#5. Net Income

Net Income is calculated by minusing the Expenses from Gross Margin. This amount is generally an indicator of the companies profitability. As mentioned above, business owners should keep a close eye on this number.

Income Taxes

These are not shown on the above graphic. However, the business owner may notice that after the accountant is done with the year end, these will show up an other expense. This entry is to show the amount of corporate taxes owed to government. It will not reduce the amount of taxes that are actually owed.

It is important to keep books up to date. If books are behind, then both the Balance Sheet and the Profit & Loss will not be able to help the business owner run the company.

You can find a video here, that gives more information on reading a Profit & Loss statement. Of course, every company is different and if you require more information on how to read your Profit & Loss you can contact a bookkeeper or accountant!