Online business – applying Canadian taxes

This remains a very confusing area for many people selling their products and services in an online business. The regulations by Canada Revenue Agency are pretty clear that the tax applies where the individual takes receipt of the product. Therefore, the tax to apply may not be the tax in your home province.

If you are selling a product to a Canadian in another province, then you likely should be selling it at their tax rate. For example, if you are a company in Edmonton, Alberta and you are selling to someone in New Brunswick, then you need to sell at 13% HST. This HST would be filed and submitted with your regular GST return.

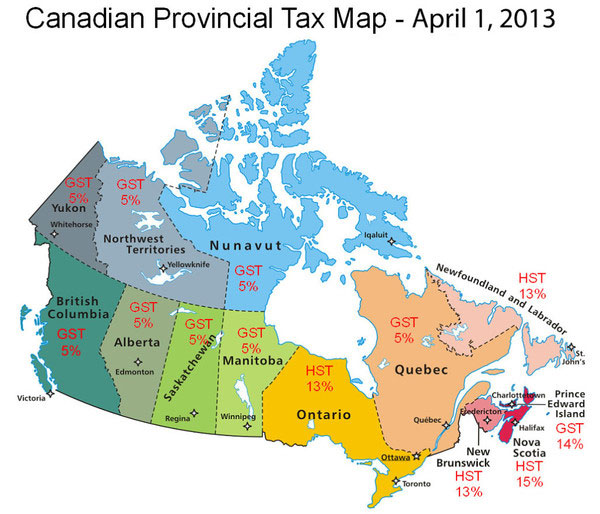

The tax rates to apply in your sale of your product or service for online businesses can be summarized by this photo. You can read an excellent article by clicking on the map or on the link below.

Many thanks to Paradise Commerce for an excellent summary. To see their full article, click here.